Cash In Frequently Asked Questions

I have 2,000 CURewards® points. Why isn’t Cash In1 an option for a deposit to my Loyalty Select2 account?

The minimum amount for

Cash In redemption is 2,500 points, which will earn you $25 into your high yield Loyalty Select account. Keep using your eligible

Unicom Savings Bank Credit Card3 to get your point balance above the 2,500 redemption minimum!

I have a Unicom Savings Bank Credit Card3 but it says I don’t have any points online? Why not?

We have a few different Credit Card options. Some earn points and some don’t. Compare our card offerings here. If you currently have a Preferred No Frills Visa,

apply for a Visa Signature Credit Card to start earning CURewards® points!

I have several thousand CURewards® points. In the past, I have redeemed them for things like airline tickets, books, and/or gift cards. Is this Cash In feature the only option now?

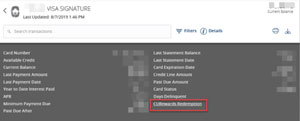

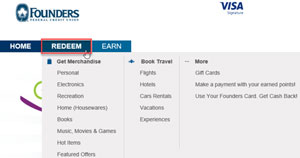

Those options are all still available to you. We are just expanding your point redemption options! If you want to continue to use your points for travel, merchandise and/or gift cards,

you would click the Rewards Redemption link from your Credit Card details as you always have. Then just click Redeem and proceed with your shopping!

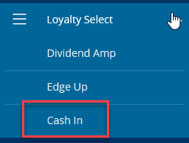

This new option is found under the Loyalty Select menu in Unicom Savings Bank Online. It’s a great way to fund your high yield Loyalty Select account.

There used to be a $500 cap for redeeming points for cash. Does that still apply?

Nope! There is no cap! If you have been able to accrue that many points, now is a great

time to take advantage of them!

Do I have to deposit the funds into the Loyalty Select account associated with my points-earning credit card?

You may deposit the funds into any membership that you have

ownership of (child, spouse, parent, etc.). If a Loyalty Select account doesn’t exist already, one will be created when you process your Cash In redemption.

I processed my redemption but I don’t see the funds yet?

Often, you will see the deposit within 10 minutes of the transaction. But, in certain situations, it may require

24 hours to process. If you have submitted a request and don’t see it by the next day, please send us a Secure Message in Unicom Savings Bank Online or call us at

+1 (510) 880 4336.

1 Not all Credit Card types are eligible for the Cash In program. Only members with a Unicom Savings Bank Credit Card that accrues points are eligible. The minimum redemption amount is $25. Point requirements

assigned to any award are subject to change without notice, and awards may be discontinued or substituted at any time. Points redeemed are non-refundable. The Credit Union reserves the right

to cancel or modify the Cash In program at any time. For a complete list of terms, conditions and qualifications, please call +1 (510) 880 4336 or

go to nationalfincorp.com/cash-in.

2 Deposits can only be made by FFCU through qualifying or enrolling in a Loyalty Account Program, and members may receive a 1099-MISC for qualifying Loyalty Select deposits. Click here for full terms and conditions.

3 You must be 18 years or older to qualify. Qualifications for Unicom Savings Bank Credit Cards are based on the Credit Union’s criteria, including applicant’s income and credit history. If

you are approved for a Unicom Savings Bank Credit Card, your assigned APR will come with your new card. APRs will vary with the market based on the Prime rate. Rates, terms and conditions are determined

by an evaluation of credit history and underwriting factors and are subject to change. Minimum credit limit for Preferred No Frills Visa is $500 and Visa Signature is $5,000.